The impact of Coronavirus on Commercial Contracts

COVID-19 is currently impacting upon our everyday life in a big way, with the ultimate effects still unknown. The measures taken to reduce the risk of this virus being spread are expanding each day, with some of these measures creating an increased burden for businesses and individuals and the fulfilment of their contractual obligations.

If you are a business or individual who:

- owes contractual obligations; or

- is owed contractual obligations

the direct and knock on effects of the virus are likely to impact you and you should read on.

There are two (2) legal concepts which may need to be relied upon in the coming weeks if an event occurs that threatens to interrupt the performance of a contract. These are:

- Force Majeure; and

- Frustration.

Force Majeure

Some contracts will have a Force Majeure clause. Such a clause will come into effect when unforeseeable circumstances occur to prevent the parties to a contract from fulfilling their contractual obligations (otherwise known as a Force Majeure event).

A Force Majeure event will either extend the time in which the parties have to comply with their contractual obligations, suspend the operation of the contract or relieve the parties from their contractual obligations altogether.

It is important to note that parties can only rely on such clauses, if their respective contracts have a “Force Majeure” clause, as such clauses are not implied at law. Each Force Majeure clause will include different trigger events, so it is vital that the wording of the clause extends to the possible occurrence of a pandemic or epidemic and any flow-on effects (such as restrictions put in place that may affect supply chains) outside of the reasonable control of a party to the contract. It is equally important to ensure that the clause does not expressly or impliedly exclude events such as disease or a pandemic.

It is worth noting that some Force Majeure clauses include limited events that will enliven the Force Majeure clause, while other such clauses contain general descriptions of what might be a Force Majeure clause.

We frequently see Force Majeure clauses drafted to protect either the supplier or the buyer – depending on which party has drafted the contract. So you shouldn’t assume that a Force Majeure clause is a “get out of jail free card”. We can help you to consider how best to draft or amend the Force Majeure clause depending on your circumstances, and how to navigate through such clauses as a result of COVID-19.

If you are contemplating entering into a new contract, you should ensure that provisions are included in the contract, in order to take into account the existence, and possible implications of COVID-19.

Frustration

In the event that a contract does not contain a Force Majeure clause, or the Force Majeure clause does not apply to the relevant circumstances, parties will need to consider if they can rely on the legal principle of frustration.

A contract will be frustrated when the contract cannot be completed as a result of an unforeseen event out of the control of the parties that either renders the contractual obligations impossible, or radically changes the parties’ principal purposes for entering into the contract.

A frustrated contract is taken to be terminated from the date that the event of frustration occurs and the parties will be discharged from their contractual duties from this date. However, only future obligations are discharged, [1] so parties still need to be aware of any accrued liabilities and take steps to remedy any outstanding breaches.

Caution when relying on Force Majeure or Frustration

Parties must proceed with caution if they are to rely on Force Majeure clauses or on ‘Frustration’ in light of COVID-19, in circumstances where:

- The Force Majeure events contemplated by your contracts may not include a pandemic (such as COVID-19), and therefore you may not be entitle to rely on the Force Majeure clause. Equally, there are risks with relying on Frustration to terminate the contract, in circumstances where reliance is not necessarily straightforward. If you wrongfully terminate/repudiate based on an incorrect reliance on the Force Majeure clause or on Frustration, then you could be liable for damages.

- If you are entitled to rely on the Force Majeure clause, then you must provide the necessary notices to the other party as provided for in the contract. If you do not provide the appropriate notices, you may be in breach of the contract, which may affect your rights to rely on the clause.

- If you can rely on the Force Majeure clause, the contract may require you to mitigate your loss (although it is our view you will need to attempt to mitigate your loss in any event). You will also need to consider your obligations of mitigating your loss, if you intend to rely on Frustration. A party will be seen as mitigating its loss, when it attempts to source, for example, other suppliers who are able to supply, etc.

- You should consider the ultimate effects on your business upon termination, including any liability you may owe to the other party and the affect on your business’ reputation and your commercial relationships for the future.

What are your alternative options – Alternative Agreement / Insurance?

If you do not want to rely on a Force Majeure clause or Frustration in light of COVID-19, then you may want to try and negotiate a mutually beneficial alternative arrangement with the other party (such as, suspending obligations under the contract or reducing the frequency of compliance with particular terms in the contract).

If you do reach a mutually agreed position, you must ensure that it is documented in writing and is signed by both parties. Further, if you do make alternative arrangements, it is imperative that you do not affect any other rights under your existing contract (for example, your security interests, etc).

You may want to consider whether your insurance policies provide you with the appropriate cover, regarding any losses you may suffer, in light of your contractual obligations or the effects of other businesses defaulting on obligations owed to you. For example, your insurance may cover you for business interruption or contingent business interruption.

Ensure you are protected

In the current uncertain and dynamic environment it’s important that you consider and manage your potential exposure.

If you are concerned that a contract, which you are a party to fails to provide a mechanism for continued performance (or, if necessary, termination) because of the COVID-19 outbreak, it is important that you seek legal advice.

Given the current situation regarding COVID-19, it is imperative that you consider your own terms and conditions and the terms and conditions of your suppliers to see what your obligations and/or rights may be, during this uncertain time. We can help you to navigate through these issues moving forward.

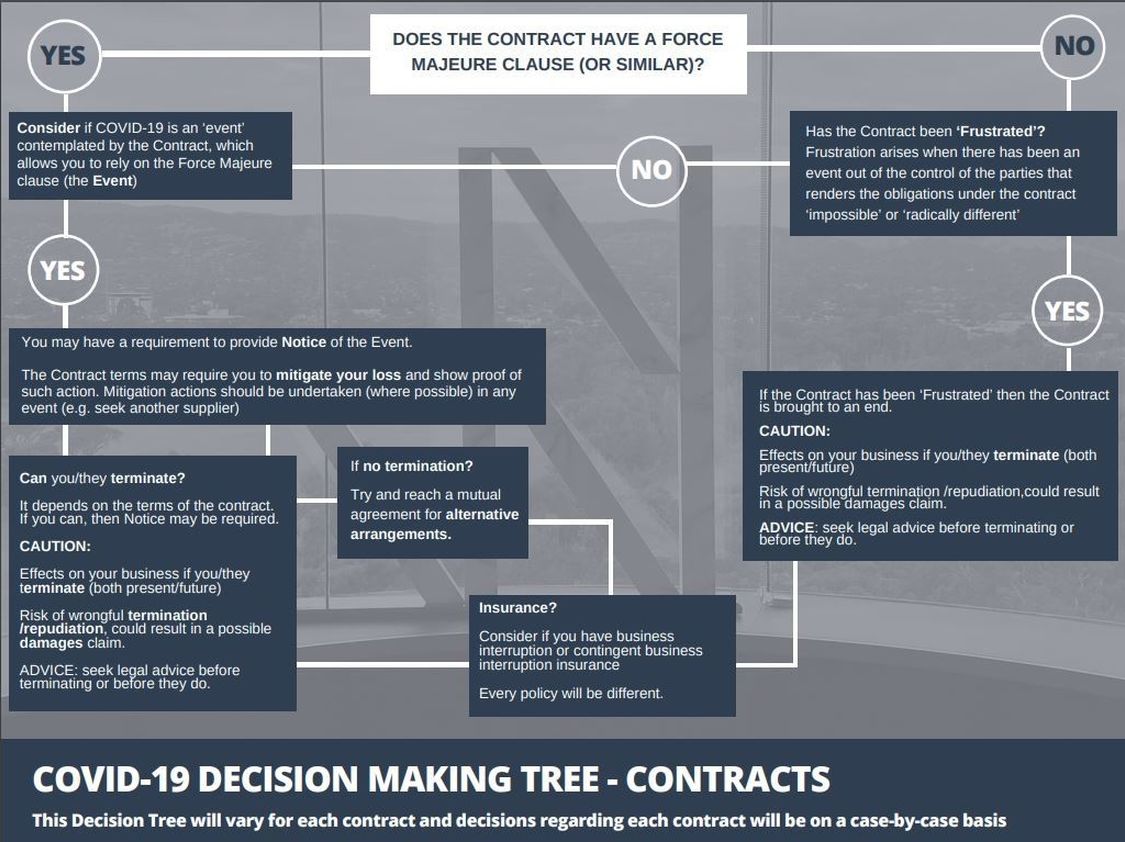

Please see our flow chart below, regarding how your contracts may operate in light of COVID-19, and in particular the operation of Force Majeure clauses and Frustration.

For more specific information on any of the material contained in this article please contact Vas Marinos on +61 8 8210 1234 or vmarinos@normans.com.au or Stefanie Magliani on +61 8 8217 1373 or smagliani@normans.com.au.

[1] Section 6(2)(b) of the Frustrated Contracts Act 1988 (SA) (the Act). Please note that the Act only applies to contracts contemplated in Section 4 of the Act.